Return on Equity (ROE) Calculator

Calculate return on equity to measure company profitability relative to shareholders' equity.

What is Return on Equity (ROE)?

Return on Equity (ROE) is a financial ratio that measures how effectively a company uses shareholders’ equity to generate profits.

ROE is calculated by dividing net income by shareholders’ equity and multiplying by 100 to express it as a percentage. It indicates how much profit a company generates for each dollar of shareholders’ equity.

A higher ROE generally indicates that a company is more efficient at generating profits from its equity base. However, it’s important to compare ROE with industry benchmarks and consider the company’s debt levels, as high leverage can artificially inflate ROE.

ROE is a key metric for investors and analysts when evaluating company performance and making investment decisions. It helps assess management’s effectiveness in using shareholder funds to create value.

Return on Equity (ROE) Formula

Return on Equity (ROE) Calculation Examples

Example 1

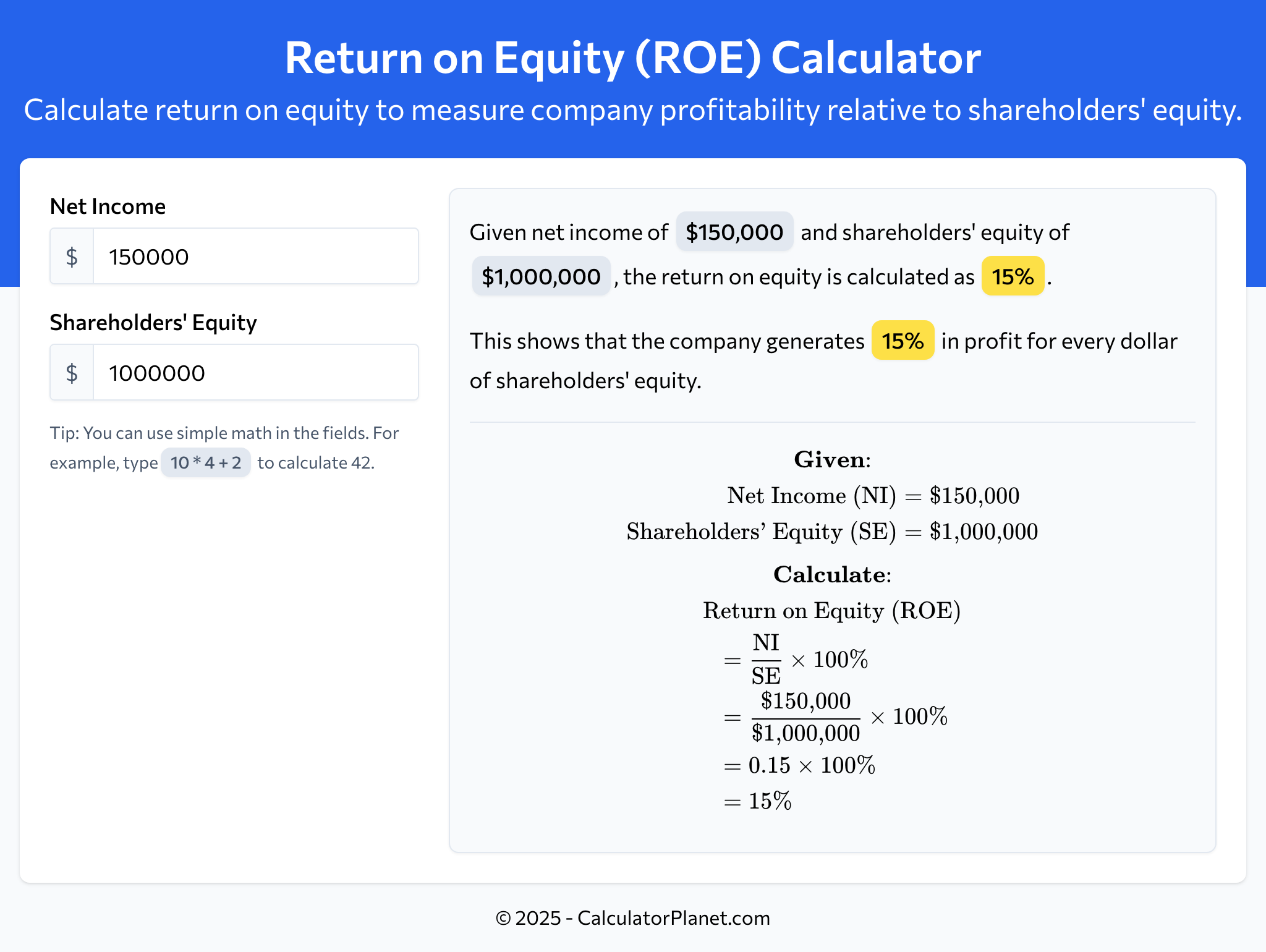

A company reports net income of $150,000 with total shareholders' equity of $1,000,000.

Let's calculate the return on equity for this company:

This indicates that the return on equity for the company is 15%, meaning that it generates 15% in profit for every dollar of shareholders' equity invested.

Example 2

A manufacturing business has net income of $80,000 and shareholders' equity totaling $500,000.

Let's calculate the ROE for this manufacturing business:

This calculation shows that the return on equity for the manufacturing business is 16%, indicating the company's efficiency in generating profits from shareholders' investments.

Reference This Page

If you found our Return on Equity (ROE) Calculator valuable, please consider referencing this page in your work. You can easily cite it by using the following formatted text:

More Calculators

- Annualized Return Calculator

- Break-Even Point Calculator

- Buying Power Calculator

- Compound Annual Growth Rate (CAGR) Calculator

- Cost of Goods Sold Calculator

- Current Ratio Calculator

- Debt to Equity Ratio Calculator

- Dividend Yield Calculator

- Earnings Per Share (EPS) Calculator

- Free Cash Flow (FCF) Calculator

- Future Value Calculator

- Gross Margin Calculator

- Marginal Revenue Calculator

- Markup Calculator

- Net Present Value (NPV) Calculator

- Operating Leverage Calculator

- Operating Margin Calculator

- Payback Period Calculator

- Present Value Calculator

- Price-to-Earnings Ratio (P/E) Calculator

- Profit Margin Calculator

- Return on Assets (ROA) Calculator

- Return on Equity (ROE) Calculator

- Return on Investment (ROI) Calculator

- Revenue Growth Calculator

- Total Revenue Calculator

- Variable Cost Ratio Calculator

- Working Capital Calculator