Return on Assets (ROA) Calculator

Calculate return on assets to measure company efficiency in using assets to generate profits.

What is Return on Assets (ROA)?

Return on Assets (ROA) is a financial ratio that measures how efficiently a company uses its assets to generate profits.

ROA is calculated by dividing net income by total assets and multiplying by 100 to express it as a percentage. It indicates how much profit a company generates for each dollar of assets it owns.

A higher ROA suggests that a company is more efficient at converting its assets into profits. This metric is particularly useful for comparing companies within the same industry, as asset requirements can vary significantly across different sectors.

ROA is valuable for investors and management as it provides insight into operational efficiency and asset utilization. It helps identify whether a company is making effective use of its resources to create shareholder value.

Return on Assets (ROA) Formula

Return on Assets (ROA) Calculation Examples

Example 1

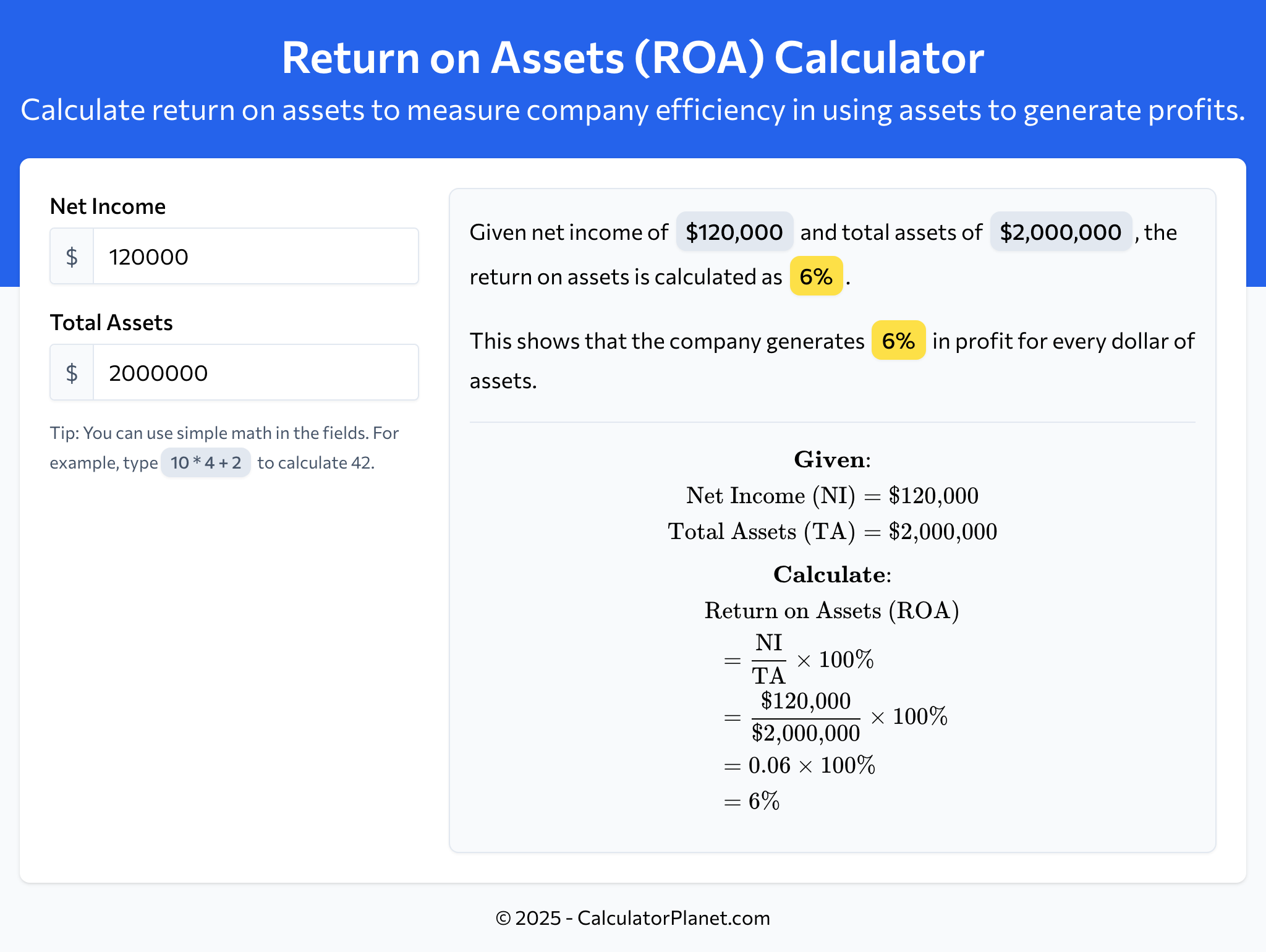

A company reports net income of $120,000 with total assets worth $2,000,000.

Let's calculate the return on assets for this company:

This indicates that the return on assets for the company is 6%, meaning that it generates 6% in profit for every dollar of assets employed.

Example 2

A retail business has net income of $75,000 and total assets valued at $1,500,000.

Let's calculate the ROA for this retail business:

This calculation shows that the return on assets for the retail business is 5%, indicating how effectively the company utilizes its assets to generate profits.

Reference This Page

If you found our Return on Assets (ROA) Calculator valuable, please consider referencing this page in your work. You can easily cite it by using the following formatted text:

More Calculators

- Annualized Return Calculator

- Break-Even Point Calculator

- Buying Power Calculator

- Compound Annual Growth Rate (CAGR) Calculator

- Cost of Goods Sold Calculator

- Current Ratio Calculator

- Debt to Equity Ratio Calculator

- Dividend Yield Calculator

- Earnings Per Share (EPS) Calculator

- Free Cash Flow (FCF) Calculator

- Future Value Calculator

- Gross Margin Calculator

- Marginal Revenue Calculator

- Markup Calculator

- Net Present Value (NPV) Calculator

- Operating Leverage Calculator

- Operating Margin Calculator

- Payback Period Calculator

- Present Value Calculator

- Price-to-Earnings Ratio (P/E) Calculator

- Profit Margin Calculator

- Return on Assets (ROA) Calculator

- Return on Equity (ROE) Calculator

- Return on Investment (ROI) Calculator

- Revenue Growth Calculator

- Total Revenue Calculator

- Variable Cost Ratio Calculator

- Working Capital Calculator