Operating Margin Calculator

Calculate operating margin to measure operational efficiency before interest and taxes.

What is Operating Margin?

Operating Margin is a financial ratio that measures what percentage of revenue remains after covering operating expenses, but before interest and taxes.

Operating margin is calculated by dividing operating income by revenue and multiplying by 100 to express it as a percentage. It focuses specifically on the profitability of core business operations, excluding the effects of financing decisions and tax strategies.

A higher operating margin indicates better operational efficiency and cost management. This metric is particularly valuable for comparing companies within the same industry, as it isolates operational performance from capital structure differences.

Operating margin is crucial for assessing management’s ability to control costs and run the business efficiently. It provides insight into the underlying profitability of the company’s core operations and helps identify operational strengths and weaknesses.

Operating Margin Formula

Operating Margin Calculation Examples

Example 1

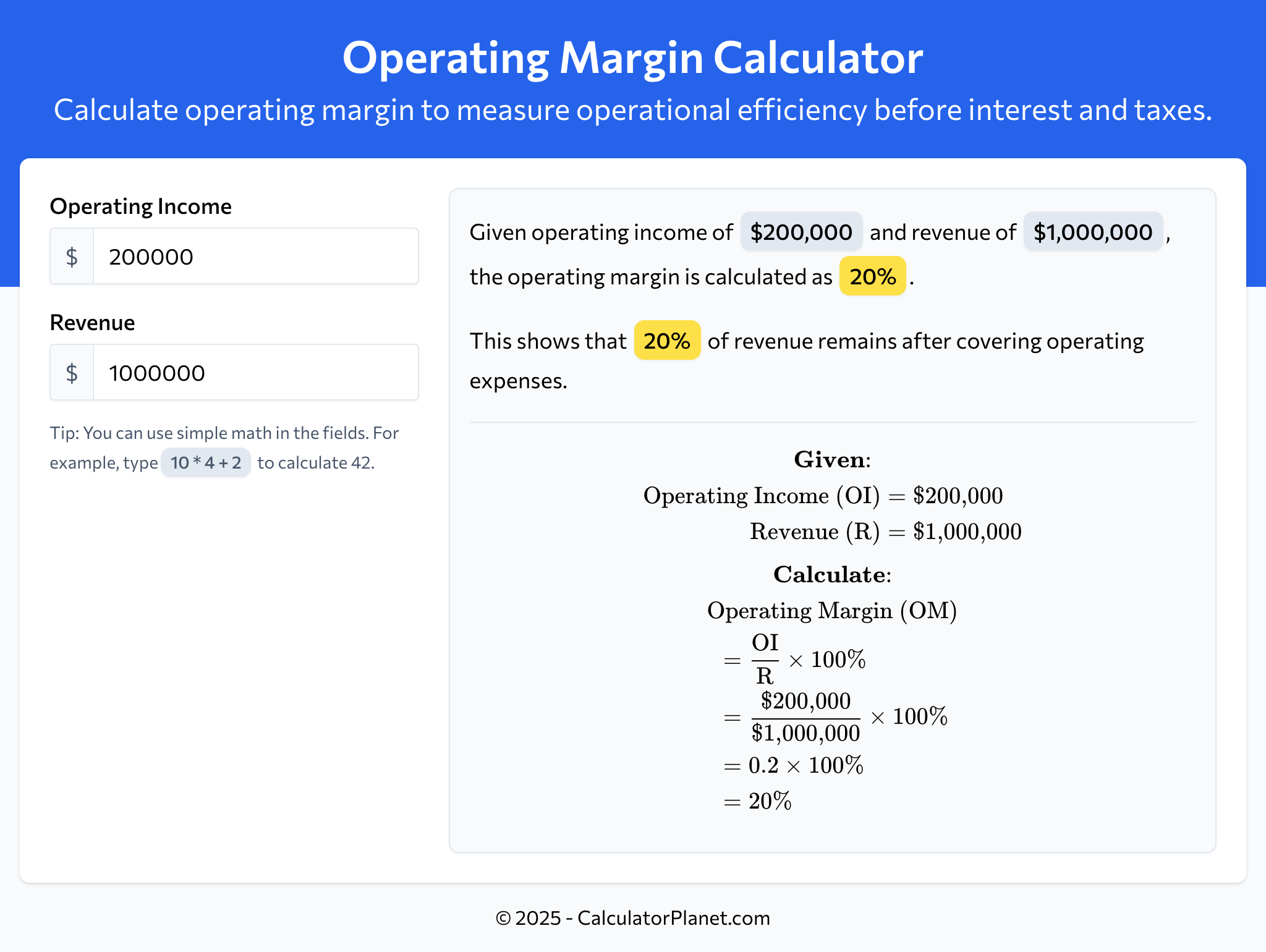

A company generates revenue of $1,000,000 and reports operating income of $200,000.

Let's calculate the operating margin for this company:

This indicates that the operating margin for the company is 20%, meaning that 20% of revenue remains after covering all operating expenses but before interest and taxes.

Example 2

A manufacturing business has revenue of $500,000 with operating income of $85,000.

Let's calculate the operating margin for this manufacturing business:

This calculation shows that the operating margin for the manufacturing business is 17%, indicating the efficiency of core business operations before financing costs.

Reference This Page

If you found our Operating Margin Calculator valuable, please consider referencing this page in your work. You can easily cite it by using the following formatted text:

More Calculators

- Annualized Return Calculator

- Break-Even Point Calculator

- Buying Power Calculator

- Compound Annual Growth Rate (CAGR) Calculator

- Cost of Goods Sold Calculator

- Current Ratio Calculator

- Debt to Equity Ratio Calculator

- Dividend Yield Calculator

- Earnings Per Share (EPS) Calculator

- Free Cash Flow (FCF) Calculator

- Future Value Calculator

- Gross Margin Calculator

- Marginal Revenue Calculator

- Markup Calculator

- Net Present Value (NPV) Calculator

- Operating Leverage Calculator

- Operating Margin Calculator

- Payback Period Calculator

- Present Value Calculator

- Price-to-Earnings Ratio (P/E) Calculator

- Profit Margin Calculator

- Return on Assets (ROA) Calculator

- Return on Equity (ROE) Calculator

- Return on Investment (ROI) Calculator

- Revenue Growth Calculator

- Total Revenue Calculator

- Variable Cost Ratio Calculator

- Working Capital Calculator