Price-to-Earnings Ratio (P/E) Calculator

Calculate price-to-earnings ratio to measure stock valuation relative to earnings.

What is Price-to-Earnings Ratio (P/E)?

Price-to-Earnings Ratio (P/E) is a valuation metric that compares a company’s current stock price to its earnings per share.

P/E ratio is calculated by dividing the stock price by earnings per share. It indicates how much investors are willing to pay for each dollar of earnings, providing insight into market expectations and stock valuation.

A higher P/E ratio may suggest that investors expect higher growth rates in the future, while a lower P/E ratio might indicate undervaluation or lower growth expectations. P/E ratios vary significantly across industries and should be compared within similar companies.

P/E ratio is one of the most widely used valuation metrics in investment analysis. It helps investors assess whether a stock is overvalued or undervalued relative to its earnings and provides a quick way to compare investment opportunities across different companies.

Price-to-Earnings Ratio (P/E) Formula

Price-to-Earnings Ratio (P/E) Calculation Examples

Example 1

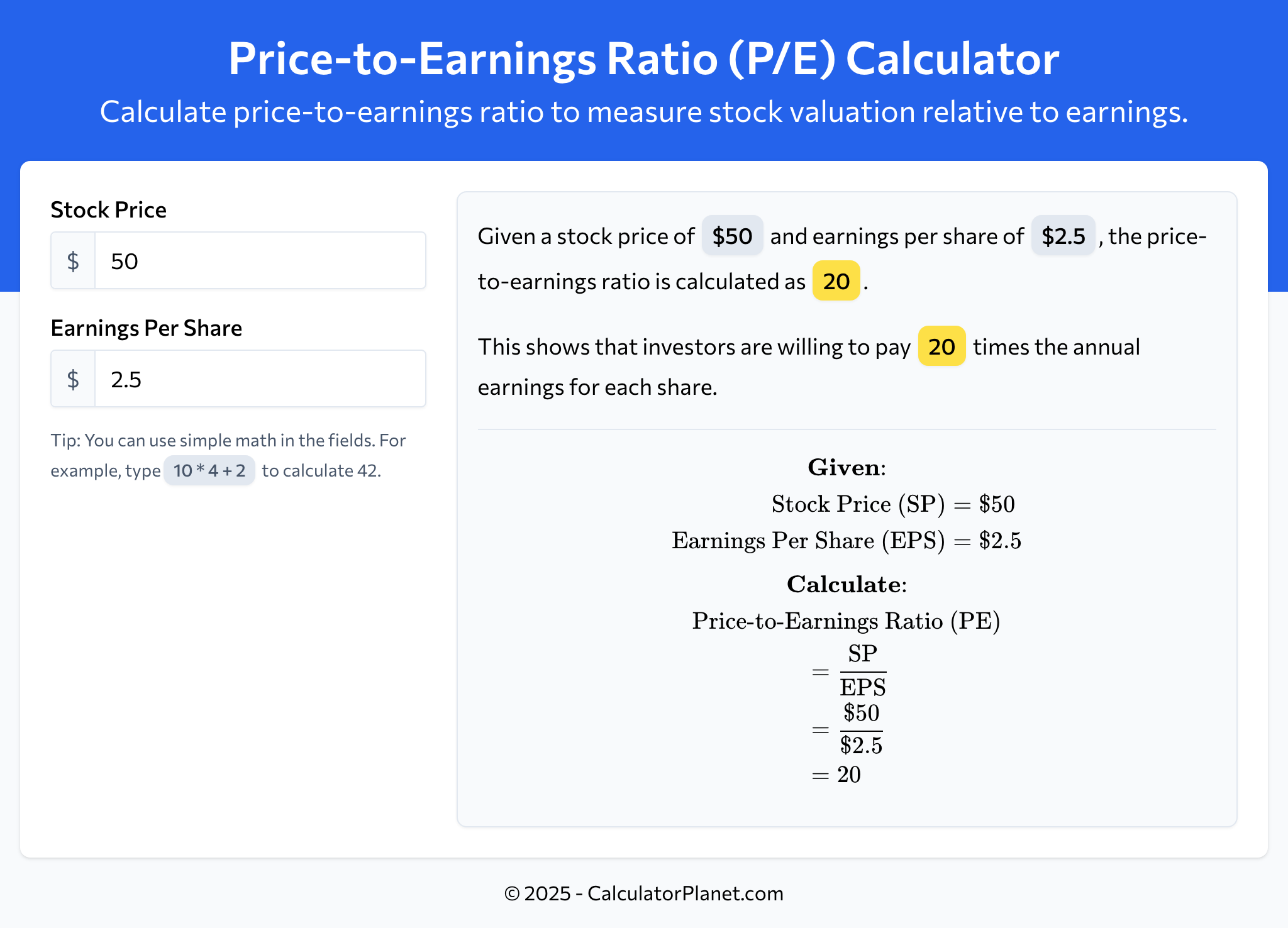

A stock is trading at $50 per share with earnings per share of $2.5.

Let's calculate the price-to-earnings ratio for this stock:

This indicates that the price-to-earnings ratio for the stock is 20, meaning that investors are willing to pay 20 times the annual earnings for each share.

Example 2

A company's stock price is $120 and its earnings per share is $8.

Let's calculate the P/E ratio for this company:

This calculation shows that the price-to-earnings ratio for the company is 15, indicating the market's valuation of the stock relative to its earnings.

Reference This Page

If you found our Price-to-Earnings Ratio (P/E) Calculator valuable, please consider referencing this page in your work. You can easily cite it by using the following formatted text:

More Calculators

- Annualized Return Calculator

- Break-Even Point Calculator

- Buying Power Calculator

- Compound Annual Growth Rate (CAGR) Calculator

- Cost of Goods Sold Calculator

- Current Ratio Calculator

- Debt to Equity Ratio Calculator

- Dividend Yield Calculator

- Earnings Per Share (EPS) Calculator

- Free Cash Flow (FCF) Calculator

- Future Value Calculator

- Gross Margin Calculator

- Marginal Revenue Calculator

- Markup Calculator

- Net Present Value (NPV) Calculator

- Operating Leverage Calculator

- Operating Margin Calculator

- Payback Period Calculator

- Present Value Calculator

- Price-to-Earnings Ratio (P/E) Calculator

- Profit Margin Calculator

- Return on Assets (ROA) Calculator

- Return on Equity (ROE) Calculator

- Return on Investment (ROI) Calculator

- Revenue Growth Calculator

- Total Revenue Calculator

- Variable Cost Ratio Calculator

- Working Capital Calculator